Looking for the best suburbs in Adelaide to invest in? Look no further, we've compiled investor information on our Top 10 for 2020. But first let's look at why Adelaide is currently a fantastic place to consider for your next investment property.

Adelaide is the food and wine capital of Australia and a market ripe for investment with record low interest rates and relatively affordable housing compared to the rest of the country’s capitals.

If you're looking for a property manager to maximise your property's ROI, contact KingsCoin today.

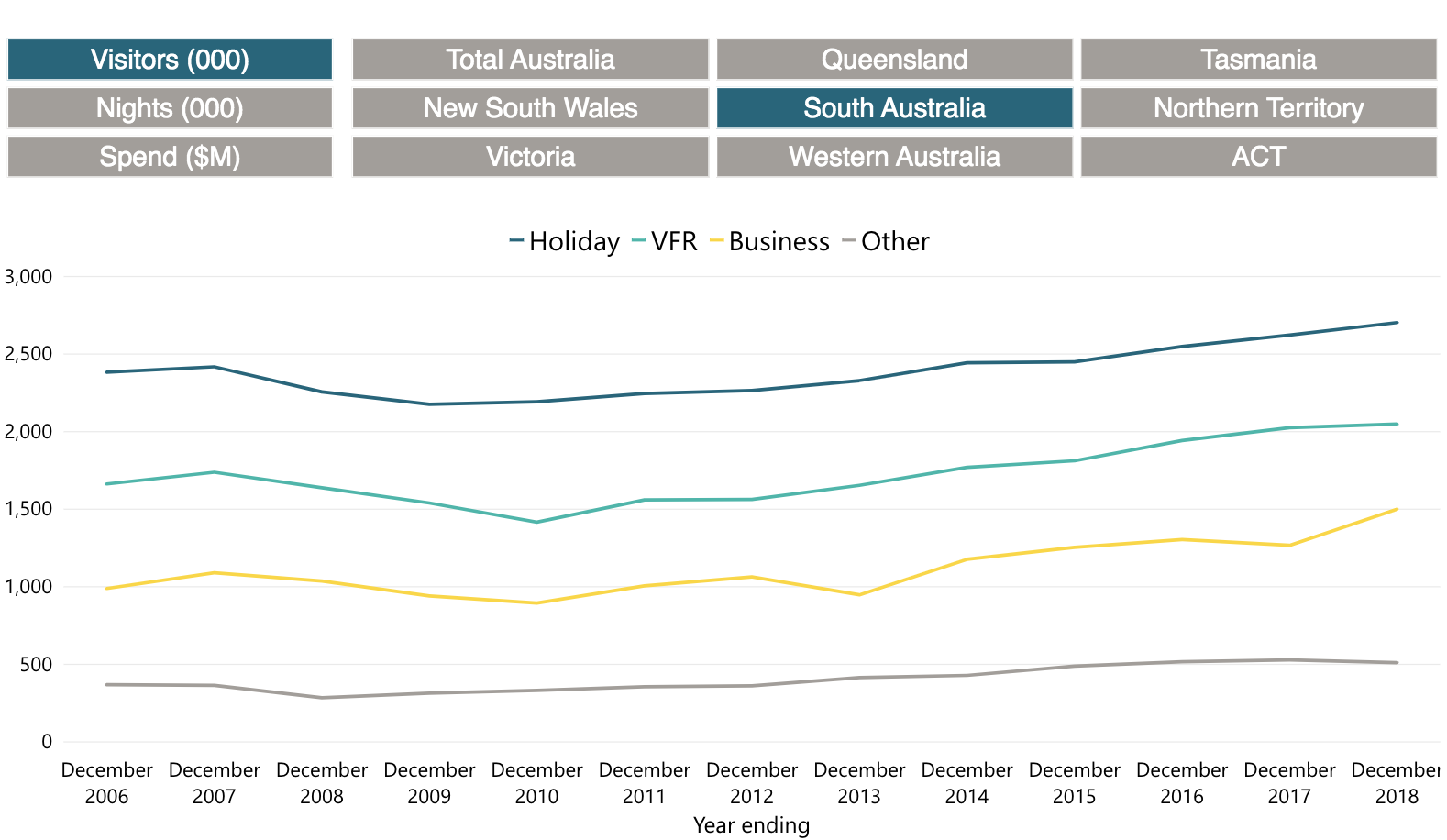

Did you know South Australia is welcoming a record number of visitors, with the state’s visitor economy soaring to an all-time-high. The biggest boost coming from interstate guests who are more frequently choosing accommodations such as Airbnb rentals.

Image courtesy of tra.gov.au

Why Adelaide suburbs are great for purchasing investment property in 2020

Three main reasons Adelaide is worth considering rent-vesting in for 2020;

- low interest rates

- stable property market

- some of the most affordable offerings nationwide

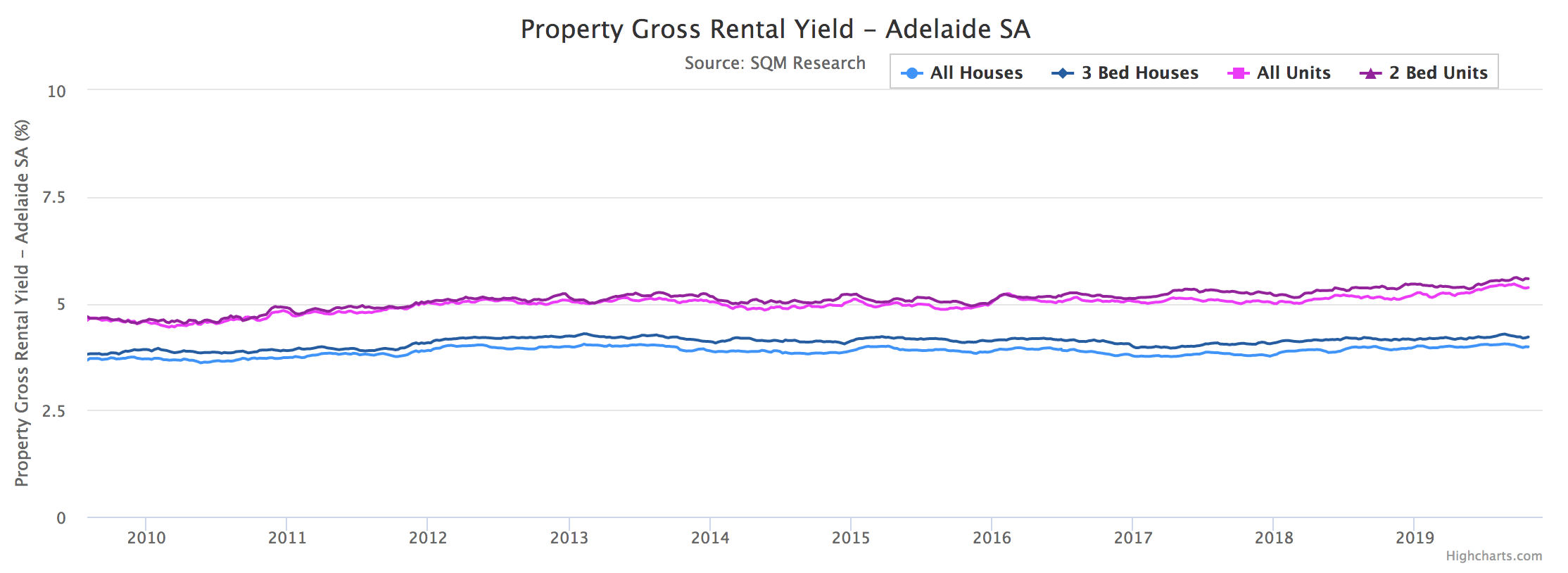

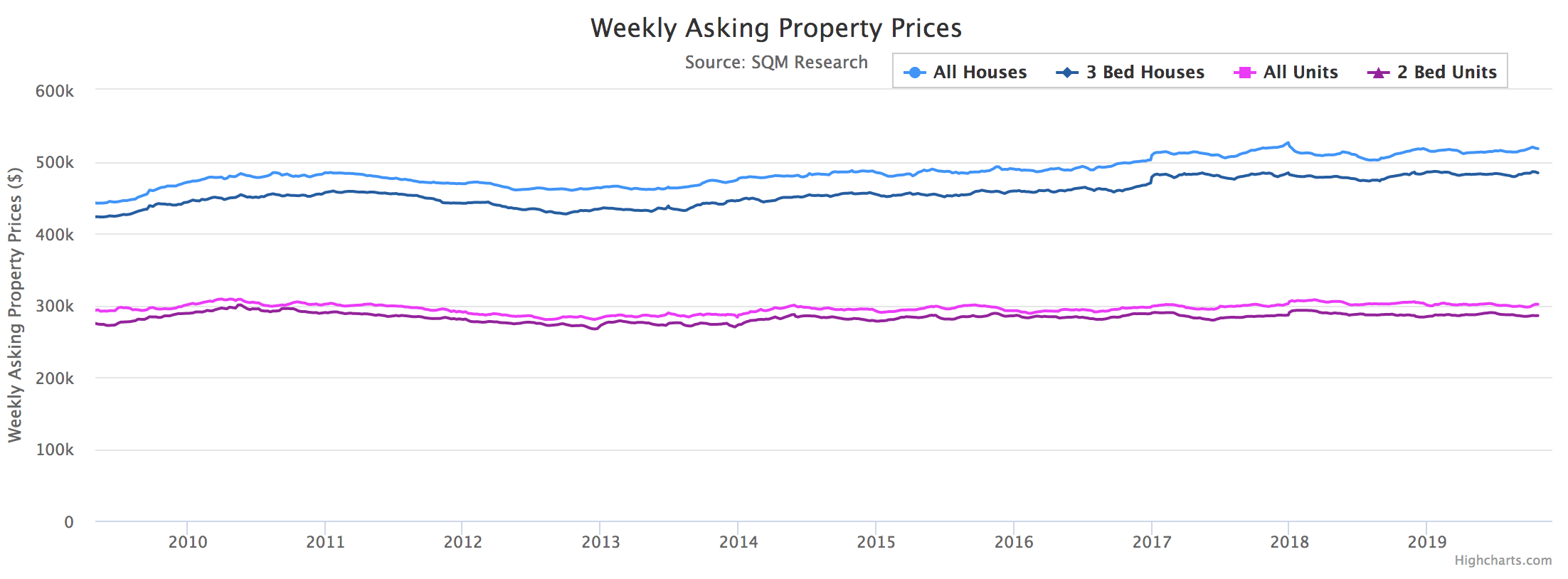

Often Adelaide investments don't suffer the rollercoaster of many of the other major cities and can offer investors a solid, stable investment as the graphs below from SQM research demonstrate.

Often Adelaide investments don't suffer the rollercoaster of many of the other major cities and can offer investors a solid, stable investment

Realestate.com reports that median property prices over the last year range from $618,000 for houses to $405,000 for units. Houses in Adelaide rent out for $450 PW with an annual rental yield of 3.8% and units rent for $440 PW with a rental yield of 5.6%.

This is using long term rental figures, when we start to explore short term options these figures look even more attractive, in some cases bringing potential rental yields up over 15%.

When we start to explore short term options these figures look even more attractive, in some cases bringing potential rental yields up over 15%.

Strategy for choosing the best suburbs in Adelaide to invest in

The two rental strategies for investment properties now commonplace after the rise of home sharing platforms such as Airbnb includes; long term or short term.

- A short-term strategy (commonly referred to as a vacation rental), is when owners lease out a furnished property on a short-term basis usually a few days to a few weeks.

- A long term strategy (commonly referred to as simply a rental), is the leasing out of a usually unfurnished property for a minimum of 6 months and generally 12 months or more.

Short term success ultimately comes down to location paired with a strong guest satisfaction strategy. Long term success ultimately comes down to your area, tenants and management of the property.

Read about the pros and cons of short term rentals vs long term rentals here.

What are the best Adelaide suburbs to invest in for 2020?

Here's our Top 10 pick for the best suburbs in Adelaide to consider when looking to include a valuable rental property into your portfolio.

We will be focusing on the best Adelaide suburbs to consider for short term rental properties with a focus on market growth and maximising your return on investment.

1. Adelaide CBD

This is the obvious choice, as it is the most preferred location for tourists and travellers. You compete well on location to even the best hotels and all of the major sites and transport are within walking distance.

Houses in Adelaide rent out for $450 PW with an annual rental yield of 3.8% and units rent for $440 PW with a rental yield of 5.6%.

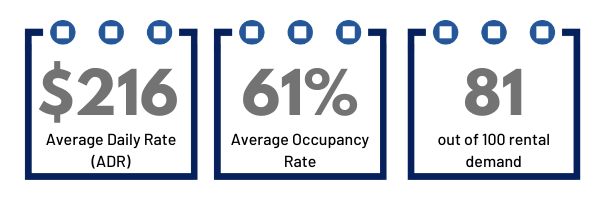

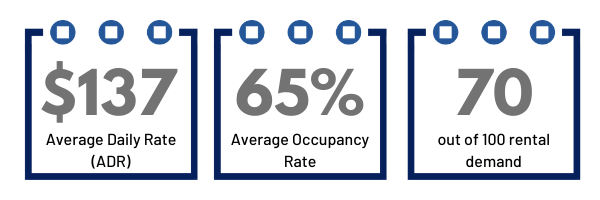

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 8.5%.

2. Keswick

Close to the airport and perfect for short term business travellers this is a suburb to consider for your next investment. It is a suburb in high demand, which often pushes prices up for good reason.

Report from realestate.com.au is that houses in Keswick rent out for $410 PW with an annual rental yield of 3.7% and units rent for $285 PW with a rental yield of 5.2%. Based on five years of sales, Keswick has seen a compound growth rate of 4.7% for houses and 7.1% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 14.9%.

With the highest indicator for rental demand according to AirDNA and a very good ADR and yield this makes Keswick one of the the best suburbs in Adelaide to invest in for 2020.

3. Parkside

Within easy walking distance to the city, home to leafy streets lined with elegant mid-sized Victorian villas, some hidden cafe gems and plenty of access to public transport, Parkside is one to watch for investors interested in securing a rental with high potential returns.

Realestate.com.au reports that median property prices over the last year range from $825,000 for houses to $418,500 for units. Consider houses in Parkside rent out for $480 PW with an annual rental yield of 3.0% and units rent for $335 PW with a rental yield of 4.2%. Based on five years of sales, Parkside has seen a compound growth rate of 4.6% for houses and 1.9% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 6%.

.png)

4. Glenelg

Reports from realestate.com.au are that Glenelg median property prices over the last year range from $975,000 for houses to $472,500 for units. Houses in Glenelg rent out for $495 PW with an annual rental yield of 2.6% and units rent for $380 PW with a rental yield of 4.2%. Based on five years of sales, Glenelg has seen a compound growth rate of 4.4% for houses and 1.3% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 6.6%.

5. Henley Beach

With its rolling lawns and cafe vibes, Henley Square sums things up: sunny, beachy and chilled-out. From modest retirement units to the palatial playgrounds of Adelaide’s affluent, Henley Beach delivers a real mix.

The realestate.com.au report is property prices over the last year range from $835,000 for houses to $360,000 for units. Houses in Henley Beach rent out for $520 PW with an annual rental yield of 3.2% and units rent for $330 PW with a rental yield of 4.8%. Based on five years of sales, Henley Beach has seen a compound growth rate of 3.8% for houses and 0.3% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 6.6%.

.png)

6. Unley

Unley is a notoriously fabulous suburb which homes some of the most classic Adelaide homes: immaculate stone-fronted Victorian villas with three or more bedrooms, generous gardens and plenty of room to park the Porsche. House prices here regularly top the million-dollar mark (sometimes double that) – top dollar for SA.

The realestate.com.au report is median property prices over the last year range from $1,068,000 for houses to $495,750 for units. If you are looking for an investment property, consider houses in Unley rent out for $500 PW with an annual rental yield of 2.4% and units rent for $350 PW with a rental yield of 3.7%. Based on five years of sales, Unley has seen a compound growth rate of 3.6% for houses and 6.3% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 4.6%.

.png)

7. Norwood

One of East Adelaide's finest suburbs with a modern portfolio of quality inner-city houses, cosy single-fronted stone cottages and slick four-bedroom contemporary townhouses makes our list for one of the best suburbs to invest in next year.

Described by realestate.com.au as "The queen of Adelaide’s eastern suburbs: hip, sassy and smitten with cafe life" it's little wonder it is popular for not only long term but also short term rental property investments.

Realestate.com.au report median property prices over the last year range from $828,750 for houses to $512,000 for units. Houses in Norwood rent out for $450 PW with an annual rental yield of 2.8% and units rent for $390 PW with a rental yield of 4.0%. Based on five years of sales, Norwood has seen a compound growth rate of 1.6% for houses and 3.0% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 5.6%.

8. Semaphore

Beachfront charm with city access as well as some hot local cafes, makes Semaphore irresistible to many a traveller.

Realestate.com.au report median property prices over the last year range from $647,500 for houses to $269,000 for units. If you are looking for an investment property, consider houses in Semaphore rent out for $450 PW with an annual rental yield of 3.6% and units rent for $300 PW with a rental yield of 5.8%. Based on five years of sales, Semaphore has seen a compound growth rate of 3.2% for houses and -1.8% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 7.5%.

9. Brompton

Close to major transport lines, major venues and a stones throw from the city life, its no wonder more and more locals and travellers alike are choosing to call Brompton their home or home away from home.

Realestate.com.au report that median property prices over the last year range from $530,000 for houses to $410,000 for units. If you are looking for an investment property, consider houses in Brompton rent out for $433 PW with an annual rental yield of 4.2% and units rent for $410 PW with a rental yield of 5.2%. Based on five years of sales, Brompton has seen a compound growth rate of 2.5% for houses and 0.8% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 8.7%.

10. Prospect

The prospects look good in Prospect for 2020.

Beautiful green leafy streets lined with Victorian villas, California bungalows and Art Deco maisonettes, plus a few contemporary townhouses and single-storey units make it a hotspot for Airbnb rentals.

Prospect property prices reported by realestate.com.au over the last year range from $732,000 for houses to $365,250 for units. Houses in Prospect rent out for $410 PW with an annual rental yield of 2.9% and units rent for $325 PW with a rental yield of 4.6%. Based on five years of sales, Prospect has seen a compound growth rate of 5.4% for houses and 3.7% for units.

Below we've gathered report data from AirDNA, when choosing the short term strategy you're looking at average annual yield from the average of all properties at 5.9%.

No matter which of our Top 10 best Adelaide suburbs you explore investment in, we can see that units being utilised as a short term rental have slightly more favourable investment figures.

This is why many investors are now seriously considering how to include more of these properties in their portfolios.

Book your free investment strategy consultation here with our Investor Support team today to find out which strategy might suit your individual needs best.

Find out more about our full range of Property Management Services here.

To calculate your properties income potential why not use our free instant online profit calculator. Get a full picture of just how much you could be earning with your investment rental property.

At KingsCoin we believe in empowering you to greater wealth through property to create your own family legacy.