What's going to happen to the property market for 2021? It's a topic never far from top of mind and certainly gets ample news coverage. But if we look through the hype, what are the figures telling us?

Is now the best time to buy real estate for the past 10 years or are we sitting with our backs to the blistering tsunami that is going to financially wipe out a generation?

Let's Put The Facts Into The Spotlight

APRA encouraged the banks to allow over 493,000 mortgages to be deferred, and the latest data tells us that 118,000 mortgages are still currently deferred.

Scott Morrison & Co have committed up to $507 billion in stimulus packages, which includes the JobKeeper program, Home Builder Grant and infrastructure investment to name a few.The RBA (Reserve bank) has previously committed up to $200 billion for banks, at close to zero interest, when they saw that their costs were increasing as a direct result of the risks within the market.

The Reserve Bank of Australia wants the Australian dollar to depreciate and is pursuing a quantitative easing (QE) program of purchasing an additional $100 billion of bonds.

According to Philip Lowe, the RBA governor, the recovery rate has been quicker than anticipated.

The RBA, through the use of its bond buying program, has committed that rates will stay low for the next three years. When it comes down to it, the ultimate influencer when it comes to interest rates is the global bond market, the cost of money. Therefore we will see the current RBA rate of 0.10 percent to remain at this until 2024 or perhaps beyond.

Economists make the prediction that inflation will increase.

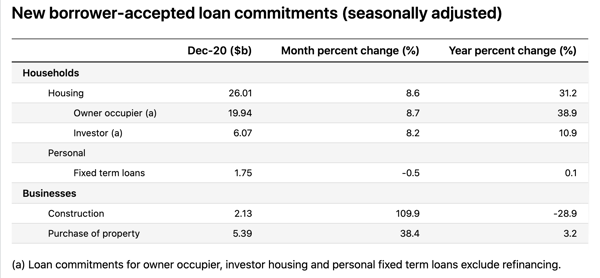

In the month of December, new home lending came to a yearly rate of 31.2 percent, up from 23.7% in November.

According to CoreLogic's home value index, nationally there was a 1 percent rise in prices during January; this marked the fourth month in a row where there was a rise after the 2.1 percent drop between the months of April and September.

There was a fall recorded of 15.9% in listing supply in SA during the month of January 2012, according to SQM research, the figure sat at 13,391 in comparison to 15,916 in January of 2020.

There was a record low growth in population as a result of COVID-19 however, there is net immigration in SA for the first time in the past two decades.

Reserve bank of Australia desires the dollar of the country to depreciate and in accord with this they are going down a course of quantitative easing (QE) which involves the purchase of an extra $100 billion of bonds. The strategy is to reduce unemployment levels which will increase the tax revenue in order to pay off the national debt while interest rates are low.

A lower currency also makes it more attractive for overseas buyers to buy Australian property and foreign direct investment becomes more attractive.

There has been an upgrade by the Reserve bank for its GDP forecast to see growth from 3% to 3.5%.

Global Risks that could be a Black Swan

- There are warning signs flashing from financial markets the world over.

- We are seeing mutated strains of COVID making their way across the globe. Will the vaccines be effective and will international travel re-open in 2021 or 2022?

- The recent projection of GameShop share price by the Reddit army is a definite bubble for that stock. However, if they can drive one share price bubble can they do it for the market generally? The behaviour has no fundamentals attached to it and therefore is something that could be a problem. Keep an eye on this.

- The trade effects on China could affect our revenue, and therefore jobs and costs. However, we have a symbiotic relationship with China so it would be foolish to put trade sanctions on our iron ore exports.

- Australia's risk profile as a AAA credit rating must be maintained, otherwise our borrowing costs will increase.

The Golden Goose can turn off the tap.

The typical mortgages being given by Australian banks are seven times the household income, this is quite high but still acceptable when the interest rates are low.

The proposal set out by the federal government to unwind responsible lending rules is yet to be addressed by a parliamentary inquiry as well as a Senate vote. This could mean that mortgages will be more easily obtained. It is not clear if that will then also mean reducing the income multiple to compensate for the increased risk.

As noted above, the banks willingness and ability to lend is critical to real estate values as the majority depend on mortgages in order to purchase.

Hey Siri, Is now the best time to buy a property?

Read about the pros and cons of short term rentals vs long term rentals here.

At KingsCoin we believe in empowering you to greater wealth through property to create your own family legacy.