Arguably, one of the best ways to invest your money is by purchasing an investment property, especially when the market is good and there's many new homes for sale available. However, purchasing an investment property that ensures the purchase increases your wealth and financial security, in the long run, is not as facile as it seems.

There are a number of common misconceptions when it comes to purchasing and maintaining an investment property. There are ups and downs in investment properties the same way they are profits and losses in other businesses.

So before you decide to jump in with two feet we suggest you learn more about investment properties in Australia, and how to manage them at a low cost to boost your rental income.

Pros & Cons of Purchasing An Investment Property in Australia

Pros:

- A tangible investment that is easy to understand, research, and work with. Moreover, it is less volatile than other investment opportunities.

- Banks are open to loans when it comes to an investment property, and can get started on the process in no time.

- Based on where in Australia you are located most costs with owning an investment home might be tax-deductible. This includes but is not limited to fees you pay, advertising, loan payouts, maintenance, and so much more.

- When invested wisely a property can deliver long-term returns, taking you over the top. Meaning you can purchase the investment property sooner than you imagined, and even sell it for a profit.

- Once you learn to keep your property expenses down you can easily expect a nice side income.

- Equity is based on the current value of your investment property, minus the amount you have yet to pay. For instance, if your investment property is valued at $900,000 and you still owe the bank $400,000; your equity will stand at $500,000.

Cons:

- Apart from the property price, there will be a number of legal fees, inspections, stamp duty, and costs to deal with. Building on the price point you had in mind.

- While you may find a slight tax cut, you must consider the capital gains tax you will be liable to pay. Taxes are generally not required for the home you live in, but income properties come with a certain tax addition.

- You need a heavy cash base, and a standard cash flow to maintain your investment property. You never know what might happen in months to come, and you will be required to pay the bank.

- The upkeep costs associated with your investment property can drain you in more than one way.

Tips To Help You Purchase The Right Investment Property

Right Place

Choosing the right property in the right place only sounds simple. It is an extremely challenging process that will determine your success or failure as a landlord.

Keeping in mind that real estate is not easy to price, you must keep your eyes open for an opportunity where you can acquire a property for less than its market value. However, you need to strike the right balance, as you do not wish to purchase a home that requires endless repairs and remodeling.

When looking for your property you want to ensure it is in a desirable location, this will help when it’s time to find suitable tenants for your investment. Finding the right tenant will help ensure your investment is being well taken care of and that your rental yields continue to come on time.

The right property locations will also mean your investment grows at a higher rate, so, how do you choose the right location?

Start by researching the area/s that you are interested in, is the property close to popular amenities such as shopping centres, hospitals, parks and attractions? Is there public transport nearby? Are there primary and high schools in the area and if so, what are the schools rating?

Other important factors to take into consideration include:

- Job growth in area

- New Infrastructure and infrastructure plans

- Are their parks, beaches or walking tracks nearby

Research

The more you learn, the more you will earn. Researching different areas offers you the opportunity you need to get ahead. Start with the basics, and choose the type of property you wish to purchase. This will help you find an area that offers suitable and profitable homes of your choosing. Once you have worked the home type, and location - you can move towards looking at properties that match your requirements.

The second step is to research your opportunity, talk to your bank, and see what is realistically possible. Moreover, you must find out how much you can actually invest without impacting your day to day life. We do not suggest going overboard with an investment that might not work. It's best to use the money you have set for investment while making sure you are leading a comfortable life.

Good sources are SQM Research and CoreLogic

Budgeting

Be prepared to offer lenders 10% to 20% of the property value as a minimum deposit. Once you have paid the lender you will be required to pay cash for stamp duty, legal fees, conveyancing fees, maintenance, insurance, and interests. Factoring in these small aspects to your budget helps you see a clear picture. In addition, you must consider how borrowing money will impact your investment.

If you need to borrow above 80% of your purchase price you will also be required to get Lenders Mortgage Insurance (LMI). When borrowing with a deposit that is less than 20% of your purchase price, the lender will reduce their risk by adding LMI as a requirement of the loan.

The cost for LMI is generally added to the total loan amount and is paid off as a part of your repayments.

Most areas in Australia have a variable interest rate, meaning your borrow cost can fluctuate at any time. Keep in mind that the changing interest rate can impact your investment, and consider a fixed interest rate plan.

Professional Help

Many first-time investment home buyers try to get things done themselves, which sounds like a great plan. However, this can quickly backfire if you miss a step in the process. Rather than saving money on such aspects, we suggest you think of this as investing money to get a profitable return.

Hiring a professional only helps you when you are new to real estate, our only suggestion is to keep your eyes open, and your mind ready to absorb all the information coming your way.

Mortgage Plan

There are endless options when it comes to financing your investment property, but the right one makes all the difference. Keeping your financial well-being in mind we suggest you find a plan that suits your unique situation. Research the market and fish for the best rates possible, then move towards finding out what aspects are tax-deductible. Knowing these small adjustments can make a huge difference in the long run.

There is no way you can assess if a fixed loan rate or a variable loan rate is the best choice. There are times when variable rates can be cheaper, but at the same time choosing the right fixed-rate loan can pay off. This is why it's best to consider all the options available and choose the one that works best for your situation.

Invest A Little More

The two main aspects that renters pay attention to are the kitchen and the bathroom. Making sure these two spaces are neutral and in good condition can help you attract a good range of tenants. Parking is another big consideration - do you need a double garage, or if you are in the inner city, is there ample street parking available?

To help you make the decision, consider if you would pay this much to live in the property you are offering. Looking through the tenants eyes helps set a more realistic approach. You must have heard that it takes money to make money, and investing in the right areas of your home can help you make money.

Long Term View

Constantly remind yourself that an investment property is a long term plan, and getting a stable and desirable income might take some time. There are no shortcuts in property investment, and just like any other investment, it might be awhile before you make an actual profit. The idea is to steadily build it up, rather than getting greedy and trying to squeeze dollars out of your tenants.

Yes, your financial security is important. However, you are not the only one at play here. Considering your tenant's situation can go a long way. If you find a great tenant who is unable to match your price, try offering a little wiggle room. Rather than ending up with a horrible tenant that damaged your property and costing you more further down the track.

Things To Consider Before Purchasing An Investment Property

Price

If there is a time to take things slow in life, it is when you are purchasing an income property. That being said, there is no golden rule to find a goose that lays golden eggs. Meaning no situation will be perfect, so find a place that fits your requirements perfectly. While the location is key to success, your budget will play a great role in the choices you make.

To ensure your making the best decision, having an understanding of how your investment will earn is vital;

Yield

Yield is the term used for your investment properties ‘rental return’ and is a measurement of the future income you can expect on your investment. It is important to note that your yield does not include any capital gains and is based only on the rental income.

How do you calculate your expected yield?

To calculate your investments gross yield you will need to know how much you can rent the property for, the average weeks of lost rent in the area and any other costs you may be expecting such as repairs and maintenance.

Then use the following formula:

[Annual rental income (weekly rent x 52) - annual expenses and costs / property value x 100]

Example:

Annual rental income ($400 x 52) - annual expenses and costs (lost rent $1200 + repairs $1000 + insurance $1400) / property value ($495,000) x 100

= 3.47%

Apart from your properties earning potential, it is important to understand property cycles to know how your invest may rise and fall with the climate at the time.

Property Cycles

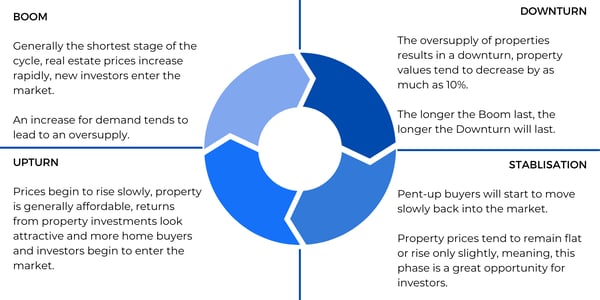

There are four stages to a property cycle; Boom, Downturn, Stabilisation and Upturn.

We can see that during the upturn and boom phase property values increase becoming more attractive to property investors, however, during the downturn and stabilisation phase property values tend to decrease or stay flat. This often scares investors and home buyers out of buying, but, this can often be the best opportunity for purchasing a property below market value knowing the cycle will move back into the upturn and boom phases.

Property cycles in the past have tended to last 7 years, this can however, vary depending on the current economic circumstances as well as political and social issues.

Realistic View

Get a realistic financial picture by getting in touch with a professional who can help put things into perspective for you. This is a small step that can offer you endless insight and a view from the other side. Knowing how much you will realistically make, and how long it will take to get a good investment plan set helps you make the right decisions.

Expenses

The smart way to start any plan is by laying down the expenses you will face, and the expenses you might face. The following are a list of expenses to take into consideration:

- Insurance

- Loan interest

- Council rates

- Strata/Body Corporate fees

- Property Management

- Maintenance/repairs

- Lost Rent

Your mortgage broker and agent will be able to advise you of the expenses you can expect prior to purchasing your property, however, the ongoing fees listed above will vary depending on your circumstance, seeking advice from an accountant may help with managing your ongoing costs.

Property Management

When it comes to managing your property there are two ways you can get the job done. You can manage the property yourself, or you can hire a property manager. If you are considering appointing yourself as the property manager then it's best to get in touch with local laws, and knowledge of the local market. Moreover, as a property manager, you will be required to take out a great chunk of your time and make sure every aspect of your property is up to the mark.

On the other hand, a property manager charges you a small fee but can help ensure your property is managed in a way that follows every local and national law/code. Moreover, they are at your beck and call and can be called in for repairs, or any tenant-related issues.

Management Process

There is a legal management process that must be followed when handling your tenants their eviction, lease agreements, security bond , and your trust accounts. Hiring a professional can go a long way in such a situation. They help you get through the legal and non-legal yet technical matters on your first income property, and you will learn a great deal in the process. Keeping these tips and tricks in mind helps you understand the process better while ensuring you will be able to deal with the issues on your own.

Think of the entire process as a learning experience and an investment in your knowledge as a landlord. The more you know the better you will be able to secure your interests. A professional comes with the know-how required to make the process smooth and flawless.

Identify Repairs

Having all the information you need beforehand ensures a smart and effective repair plan. Get an assessment of how much it will cost to bring your property to the standard you wish to achieve - then add a little more to the number as a precaution. It is no secret that small repairs can turn into a big renovation.

Staying ahead of yourself and the property allows you to make well-educated decisions. Meaning you will purchase the property only if you can easily manage the repairs.

Based on where you are located you need someone who will handle the ongoing repairs of your rented property. It must be you, or someone you can easily trust to get the job done the right way - without blowing through your budget.

Recent Repairs

There are times when you will find yourself leaning towards a property based on the “recent repairs” listed on the property you are interested in purchasing. However, your job is to ensure how well these “recent repairs” were done.

There is a good chance that the previous owner did some modification to the home, and even got a few tweaks done to make the property appear more worthy than the rest.

However, the key to success when purchasing any property is to investigate on your own time and dime. If necessary pay a professional to come in and check the state of the home you are interested in purchasing.

Moreover, you must ensure that everything was done up to code, and is in the state the seller claims it to be. This is the only way to make sure you do not end up purchasing an income property you have to rip down to the studs and rebuild again following basic codes.

Marketing Plan

The way you market your investment property will set the tone of tenants that come your way. This is why you need to find the right marketing platform, and a plan that ensures you get a list of potential tenants that match your property and your requirements.

Rather than waiting till you get your income property, we suggest you start your research now. Having a plan in place ensures you can start marketing your place the right way as soon as you get possession.

Always keep separate cash for marketing. The money invested in a marketing plan ensures the success of your rental property. Finding good tenants who will take care of your home, and treat it the way you would, is a blessing.

A blessing that is only offered to those who find the right tenants.

Payment Plan

Payment Plan

The best way to ensure smooth payments is by setting up a payment plan that works. A payment plan is not only how and when the tenant will pay you. In addition, it includes a complete guide on what the payment time frame is, what happens when the tenant fails to pay on time, vacancies etc.

Furthermore, being proactive secures your interests, and ensures the tenant knows what can happen if they fail to pay on time. A complete action plan set beforehand will offer you a great deal of comfort, rather than come up with a plan after you are stuck in a certain situation.

The best way to avoid the hassle is by setting a working system in place. Making sure the tenant knows you are professional and are set up and ready to take on any issue that arises.

Legal Regulations

There are local and federal laws you need to consider before taking on an investment property. It's ideal to get to know every single regulation and law set in place before you decide to purchase an investment property.

Being the landlord you are responsible for a great deal, to avoid any legal trouble go through every law and local regulations.

Learn more about the state rental codes:

Type of Property Investments

If you are looking to invest on a smaller scale we suggest you look at investing in ASX (Australian Stock Exchange). The stock market offers interesting property investment choices that match your budget. This is a great way to ensure diversification across assets, greater liquidity, and lower transaction rates. In addition, keep in mind that share prices can fall and rise on a daily basis, and are not set in stone.

You can start with:

- Real Estate Investment Trust. (REIT’s)

- Investing in Home Construction.

- Self-Managed Super Fund - SMSF.

These are some of the many options available for investors who are unable to find a profitable investment property in their budget.

Getting started on one of these can help them save over the years for an actual income property that offers you great returns. Rather than compromising and choosing a property that is likely to eat through your investments.

Investing is not an easy feat, and requires a great deal of time and money. The only way to ensure your best interest is protected is by choosing a plan and path that works best for you.

There is no sure way to make money off an investment, as it relies deeply on the opportunity at hand. What might seem like a solid deal may end up losing you money in the long run, so take your time to go through each aspect and make decisions based on your situation, rather than someone else's experience.