.jpg?width=700&name=Blog%20Headers(12).jpg) The Australian Bureau of Statistics (ABS) has released the first round of Housing Finance Data for 2017. Here are the stats:

The Australian Bureau of Statistics (ABS) has released the first round of Housing Finance Data for 2017. Here are the stats:

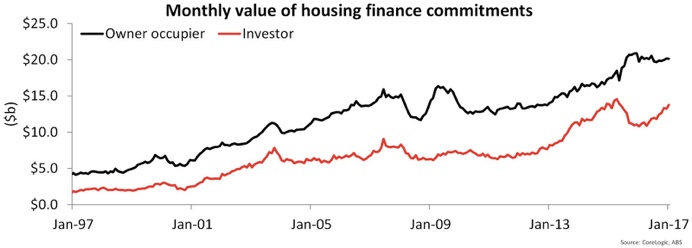

January 2017 figures have revealed $33.9 billion in housing finance commitments nationally. That signals a 1.5% increase from December 2016 and an 11% increase since the same time in 2016.

Diving deeper in, we discover that commitments from owner occupiers fell by -0.2% for the month, while investors commitments rose by 4.2%. The overall value of owner occupier commitments remains -3.7% short of its peak value of $20.9 billion in December 2015, while investor commitments are also -5.3% lower than its historic peak of $14.6 billion in April 2015.

Diving deeper in, we discover that commitments from owner occupiers fell by -0.2% for the month, while investors commitments rose by 4.2%. The overall value of owner occupier commitments remains -3.7% short of its peak value of $20.9 billion in December 2015, while investor commitments are also -5.3% lower than its historic peak of $14.6 billion in April 2015.

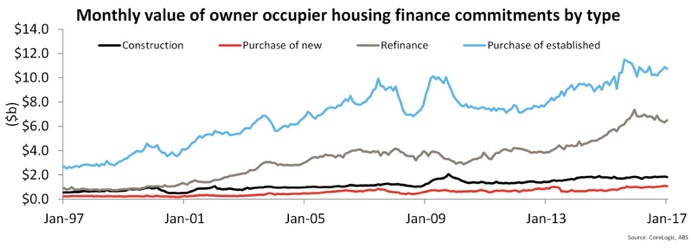

Looking at the where owner-occupiers were committed, there was $1.8 billion for construction, $1.1 billion for the purchase of new homes, $6.5 billion for refinancing of established dwellings and $10.7 billion for the purchase of established homes. Refinances were the only component of owner-occupier housing finance commitments that increased over the month (+2.6%) with construction down -2.3%, purchase of new falling -2.1% and purchase of established dwellings -1.3% lower.

Looking at the where owner-occupiers were committed, there was $1.8 billion for construction, $1.1 billion for the purchase of new homes, $6.5 billion for refinancing of established dwellings and $10.7 billion for the purchase of established homes. Refinances were the only component of owner-occupier housing finance commitments that increased over the month (+2.6%) with construction down -2.3%, purchase of new falling -2.1% and purchase of established dwellings -1.3% lower.

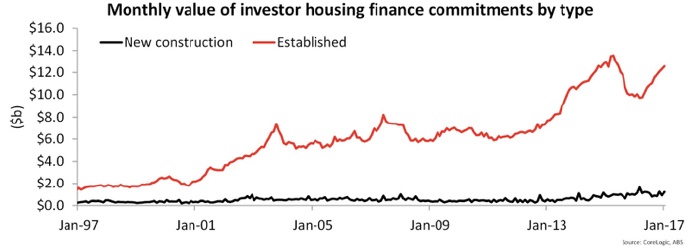

Meanwhile, investor commitments were split between $1.2 billion for the construction of dwellings and $12.6 billion for established dwellings. Over the month, the value of housing finance commitments increased by a seasonally adjusted 34.2% for construction and by 2.0% for established dwellings.

Meanwhile, investor commitments were split between $1.2 billion for the construction of dwellings and $12.6 billion for established dwellings. Over the month, the value of housing finance commitments increased by a seasonally adjusted 34.2% for construction and by 2.0% for established dwellings.

What this all means?

Investors are currently driving Australia’s property market, while owner occupier mortgage demand continues to cool off. The increase in refinancing may be due to some lenders adjusting mortgage rates, allowing owners to shop around for a better deal.

As CoreLogic comments: “With investor and upgrader demand so substantial currently in the housing market, potential first home buyers are facing higher competition with other segments of the market which is clearly affecting their ability or willingness to participate in the market. Those that already own homes have benefitted from the ongoing value growth across many regions of the country. Subsequently, those who already own a home have more housing equity and are able to pay more for those homes as an investment than first home buyers who are likely to be targeting similar properties for owner occupation. Given that owner occupier first home buyer finance commitments are at an historic low it is no wonder the federal government is coming under increasing pressure to do more to assist housing affordability.”

As CoreLogic comments: “With investor and upgrader demand so substantial currently in the housing market, potential first home buyers are facing higher competition with other segments of the market which is clearly affecting their ability or willingness to participate in the market. Those that already own homes have benefitted from the ongoing value growth across many regions of the country. Subsequently, those who already own a home have more housing equity and are able to pay more for those homes as an investment than first home buyers who are likely to be targeting similar properties for owner occupation. Given that owner occupier first home buyer finance commitments are at an historic low it is no wonder the federal government is coming under increasing pressure to do more to assist housing affordability.”

Are you seeking expert advice to develop your property investment strategy? Please don't hesitate to contact KingsCoin and discover more about how we can assist you to create wealth from your next property purchase.