COVID-19 has shocked all businesses to its core, one of which is the rental housing market. Apart from reducing demands of rentals, there is a peak in the supply of rental properties; while some are stuck with non-paying tenants. With COVID still rising what can you do as a property owner in Australia.

Prior to COVID rental markers were on the rise with low development there was a high demand; making it a solid investment. However, with COVID still at large property owners are unsure of their current and future conditions.

State Codes For Rents During COVID-19

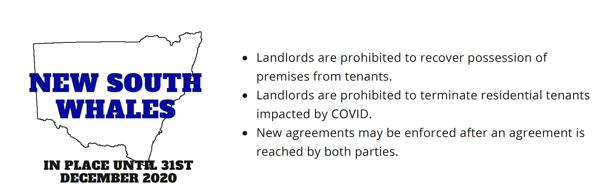

New South Wales

The New South Wales Government set in place some significant changes laid down by the Cabinet, which are now extended until the 31st of December 2020. These include the following temporary adjustments to the Residential Tenancies Act:

- Landlords are prohibited to recover possession of premises from tenants.

- Landlords are prohibited to terminate residential tenants impacted by COVID.

- New agreements may be enforced after an agreement is reached by both parties.

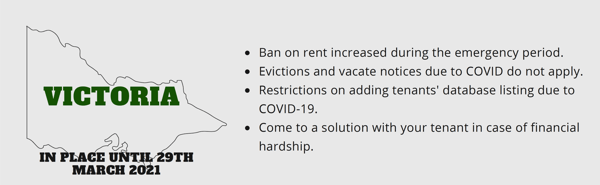

Victoria

The Victorian Government has set in place specific laws in light of the Coivid19 Act. Passed by the Cabinet for 6 months, these temporary laws will stand in Victoria until 29th March 2021. These temporary laws set due to COVID are:

- Ban on rent increased during the emergency period.

- Evictions and vacate notices due to COVID do not apply.

- Restrictions on adding tenants' database listing due to COVID-19.

- Come to a solution with your tenant in case of financial hardship.

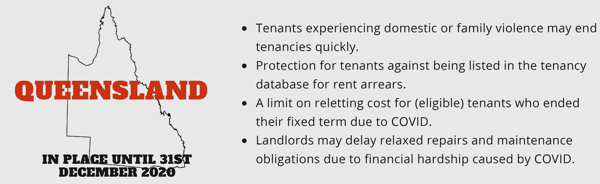

Queensland

Queensland

The Queensland Government implemented the Cabinet agreed 6 months moratorium for rent arrears due to COVID. These temporary protections for Queensland tenants and landlords have changed from 30th September 2020. The 6-month eviction halt and proposals set in place to aid won't be applicable after 29th September 2020 - covering the following:

- Fix term agreement extensions due to COVID-19.

- Ending agreement that stops landlords from ending tenancies due to COVID-19, or even ask for vacant possessions in light of a sale.

- Rent will go back to its standing rate before COVID-19, any agreement entered due to COVID-19 will be null and void.

- RTA will deal with tenancy disputes related to COVID-19.

The protections that will continue until 31st December 2020 include:

- Tenants experiencing domestic or family violence may end tenancies quickly.

- Protection for tenants against being listed in the tenancy database for rent arrears.

- A limit on reletting cost for (eligible) tenants who ended their fixed term due to COVID.

- Landlords may delay relaxed repairs and maintenance obligations due to financial hardship caused by COVID.

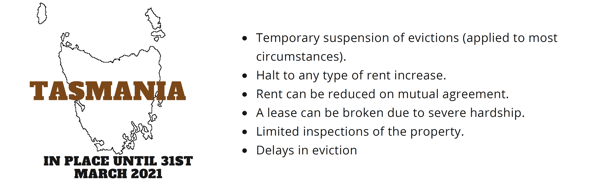

Tasmania

Tasmania

The Tasmania local government has decided to extend the emergency state for residential tenants until the 1st of December 2020. With COVID still at large, the protections that were initially put in place at the end of March 2020 are still in play. Under the COVID-19 Disease Act 2020 the protections are as follow:

- Temporary suspension of evictions (applied to most circumstances).

- Halt to any type of rent increase.

- Rent can be reduced on mutual agreement.

- A lease can be broken due to severe hardship.

- Limited inspections of the property.

- Delays in eviction

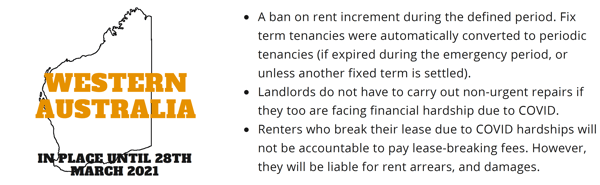

Western Australia

Western Australia

A law was passed in March titled COVID-19 Response Act 2020 offering tenants some relief. In light of the recent developments, the Western Australian Government has decided to extend the relief period until 28th March 2021. The main laws set in place that impact landlords the most are:

- A ban on rent increment during the defined period.

- Fix term tenancies were automatically converted to periodic tenancies (if expired during the emergency period, or unless another fixed term is settled).

- Landlords do not have to carry out non-urgent repairs if they too are facing financial hardship due to COVID.

- Renters who break their lease due to COVID hardships will not be accountable to pay lease-breaking fees. However, they will be liable for rent arrears, and damages.

These laws apply to residential tenancies that include park homes, boarders, lodgers, and public & government housings.

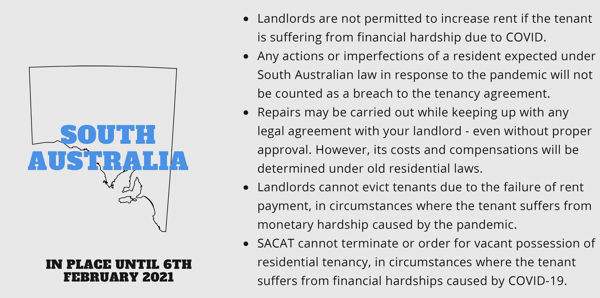

South Australia

South Australia

The impact of COVID can still be felt, due to which there has been a shift in the rental market. The South Australian Government passed a COVID-19 Emergency Response Act 2020, making temporary changes to residential tenancy law. The law set in place cuts back on the impact of homelessness, and is said to continue on until 6th February 2021 - or 28 days after COVID-19 ceases to exist in SA. The main changes included in the Response Act are:

- Landlords are not permitted to increase rent if the tenant is suffering from financial hardship due to COVID.

- Any actions or imperfections of a resident expected under South Australian law in response to the pandemic will not be counted as a breach to the tenancy agreement. Or could lead to grounds of termination.

- Repairs may be carried out while keeping up with any legal agreement with your landlord - even without proper approval. However, its costs and compensations will be determined under old residential laws.

- Landlords cannot evict tenants due to the failure of rent payment, in circumstances where the tenant suffers from monetary hardship caused by the pandemic.

- SACAT cannot terminate or order for vacant possession of residential tenancy, in circumstances where the tenant suffers from financial hardships caused by COVID-19.

The laws set in place do not mean tenants can stop paying rent, along with water, electricity, and other bills. Or that the tenant will not be required to repay due rent. The landlords and tenants are expected to work together and come to a reasonable arrangement. If you are unable to reach an agreement you can dispute the case in front of the SACAT.

National Code for Commercial Leasing During COVID-19

The national code for commercial leasing during COVID-19 was set by the PM, offering every detail needed to work around the pandemic. The cabinet drew up a set of principles based on commercial leasing.

These temporary laws passed by the Cabinet and Premiers and Territories Chief Ministers will be set in all states - They include:

- No tenant can be evicted if the rent is not paid on a commercial lease due to CoronaVirus impact.

- A reduction in rental payment or waiving rental payments can be implied if agreed by the landlord and tenant.

- Tenants may apply to end their lease or seek mediation due to financial distress.

- Landlords and tenants that are stable even during the pandemic are requested to honour their previous standing agreement.

- Land Tax Relief For Landlords

Local governments in Australia are now offering land tax relief for landlords in hopes to help them float during the emergency period. Tax relief is being offered to non-residents and residential landlords. The relief is divided into two periods for both residential, commercial residential and non-residential landlords.

Initially, the tax reduction relied on the relief the landlord is offering tenants impacted by COVID-19. Or rent the landlord has lost from March 30th, 2020 to October 30th, 2020 (covering the first period).

The first relief application period closed on 30th September 2020, and the expanded (second period) tax relief is offered to landlords that offer their tenants relief due to COVID-19. Covering the period from 31st October 2020 to 30th April 2021. - Applications will open soon.

Residential Homes

One of the main criteria that makes landlords eligible for land tax relief are those who reduced rents and offered some relief to tenants. The amount the landlord let go will be the same as the amount of land tax relief they are offered. Additionally, a landlord is eligible for tax relief if their property remained untenanted due to COVID - and for a specific period of time.

Landlords can claim a 25% cut on the 2019-20 land tax on eligible property, while the maximum reduction rate goes up to 50% on 2019-20 land taxes.

How Can Residential Landlords Apply for Land Tax Relief

Eligibility:

- Received a Land Tax Notice of Assessment for 2019 to 2020

- No outstanding land tax debt dating from 2019 to 2020.

- The land is only used for residential purposes.

OR

- The land was leased to a residential tenant(s) on 30th March 2020 and was leased by the tenant for a relevant period - during which you reduced the rent on tenants impacted by the pandemic.

- At least one of your tenants delayed financial hardship due to COVID-19. (Loss of job, reduced working hours, pay cut, etc.

OR

- The land was leased to the tenant(s) on 30th March 2020, and since then at least one of them has vacated the space. Additionally, you have been unable to secure a new tenant during the impacted period.

Relevant Periods

The two stages of Land Tax Relief are:

- Period 1: 30th March 2020 to 30th October 2020

- Period 2: 31st October 2020 to 30th April 2021

Note: Each period is assessed separately, and the landlord must meet the criteria set for the said period including:

You have offered rent relief to your tenant, and your tenants meet the emergency criteria.

Or if your property has been vacated due to COVID and you have lost rent.

Understanding Landlord Tax Relief

While the maximum tax relief offered by the Government is 50%, it is offered in two sections. 25% covering each period.

Period 1:

The landlord may receive the full amount they have relieved the tenants of or lost due to vacant tenancy between March 30th, 2020, and October 30th, 2020. There is a chance you may get a lower cut on your land tax based on the rent relief you offered, or if your tenant meets relief requirements.

Period 2:

The landlord may receive the full amount they have relieved the tenants of or lost due to vacant tenancy between October 31st, 2020, and April 30th, 2021. There is a chance you may get a lower cut on your land tax based on the rent relief you offered, or if your tenant meets relief requirements.

Evidence To Support You Claim

Once you start working on your form you will receive specific evidence requirements based on your situation. Meaning each situation may require a set of evidence. Which can include, but are not limited to:

Tenant Property

- A lease agreement or written contract that exists between the landlord and the tenant.

- A statement signed by the landlord (an agent) and the tenant acknowledging a reduction in rent was offered by the landlord (Note: Deferred rent is not considered as rent relief).

- Evidence stating that you will reduce or have already reduced rent for affected tenant(s) while showing the amount of relief provided.

Untenanted Property

- Date when the property was available for rent.

- A document showing your efforts to lease your property (advertisement copy, social media screenshots, or a copy from a property agent or management company).

- Evidence showing the amount of money you have lost due to a tenants unexpected departure.

How To Apply

- Period 1 applications closed on 30 September 2020.

- Period 2 applications will open soon and close on 30 April 2021.

Relief Method

Landlords who haven't paid the complete amount of their 2019 to 2020 taxes - Will be offered relief in the form of a credit against an outstanding land tax from 2019 to 2020.

Landlords who have paid the full land tax for 2019 to 2020 - Will be offered relief in the form of a credit against their future tax liabilities or even as a refund.

Choose The Option On The Application Form

You can choose the way you wish to receive your relief. Once your application is approved you will receive credit or cash based on your request.

Landlords who choose a refund are required to state their account details on the application form. When choosing a refund by cheque, it will automatically be posted to your address on record.

A 25% Land Tax Reduction Possible On One Rent Reduction?

Yes, you are eligible for relief up to the amount you have offered as a relief to your tenant. The maximum cap is 25% of relief, anything more than that will still be capped under 25%.

For instance, if you offered a once-off rent of $250, and your land tax is $2000. Then you can claim a relief you provided. As $250 is less than 25% you are eligible for a cut of $500 on your $2000.

Rent Relief Provided in Period 1 As Evidence in Period 2?

No, only the relief provided in the specific period will be counted as eligible evidence. Unfortunately, if you have missed the application deadline for period 1 there is no way you can reclaim that amount.

Tenants Who Do Not Face Financial Hardship

If your tenants do not face financial hardship due to the pandemic you cannot apply for relief. Additionally, you are legally within your rights to stand your ground on the rent they were paying you before the emergency period was enabled.

Commercial Leasing

Commercial leasing that offered relief to their tenants can now file for relief while paying property taxes. A system enforced by the government to help them keep their household afloat during the pandemic.

Relevant Period

- Period 2: 31st October 2020 to 30th April 2021

Eligibility

- If you have received a notice of Tax assessment for 2019 to 2020.

- There are no outstanding taxes on your land prior to 2019 to 2020.

- Your commercial building is used for non-residential purposes.

- An active business is conducted from your property.

- You own the property and business through a company or directly.

OR

- The business you run is eligible for Australia Government's JobKeeper Payment.

- The business does not make more than $50 million per year.

Note: Properties that are being developed for sale are not eligible. Unless and until you are conducting an active business on the property. Development or construction work does not qualify as an active business.

How Much Relief is Offered

The relief offered is based on a number of factors, along with its range. Once you meet the criteria, then you will receive a 25% relief in land tax based on a number of factors based on your unique situation.

Evidence Required

The evidence required is based on the situation, which will start to appear as you fill in your criteria. The general evidence required can be, but is not limited to:

- You are running a business on your property that is eligible for JobKeeper Payment - 31st October 2020.

- Evidence stating that your business does not make more than $50 million per annum.

How To Apply

The application period starts soon and will close on 30th April 2021.

Relief Method

Landlords who haven't paid the complete amount of their 2019 to 2020 taxes - Will be offered relief in the form of a credit against an outstanding land tax from 2019 to 2020.

Landlords who have paid the full land tax for 2019 to 2020 - Will be offered relief in the form of a credit against their future tax liabilities or even as a refund.

Choose The Option On The Application Form

You can choose the way you wish to receive your relief. Once your application is approved you will receive credit or cash based on your request.

Landlords who choose a refund are required to state their account details on the application form. When choosing a refund by cheque, it will automatically be posted to your address on record.

Business Was Eligible For JobKeeper Before 28th September 2020

If your business is not eligible for JobKeeper after 28th September 2020, then you are not eligible for relief.

Business Turnover Per Annum

To be eligible for the relief your business turnover from 2018 to 2019 should be less than $50 million. However, if the business set on the property is a franchise, then the turnover for that particular franchise must be less than $50 million.

Who Does The Code Apply To?

The code is applicable to all commercial leases which include retail, industrial, and office leases - where the tenant:

Suffers from financial stress or hardship caused by the pandemic - As defined by the JobKeeper Program and Commonwealth Government. Additionally, the tenant has an annual turnover is less than $50 million.

Relief Scheme For Landlords

In such a state landlords have two main financial relief choices - These choices can help you keep the ball rolling for the time being. Once secured you can begin negotiations with your tenants.

Banks

The first step is to apply to your bank for a deferment in your mortgage repayments. Or you can get them partially deferred for six months. Most banks in Australia are offering measures as a relief to help support customers facing financial hardship during COVID. That being said, the bank needs to make its money back. Meaning, the interests, and repayments will show on your loan plan. The best way to ensure relief from your bank is by offering them proof that you have lost rental income.

Landlord Insurance

Double-check to confirm if your landlord insurance covers the rental loss. Under these unusual circumstances, a loss of rent is covered by insurance companies for a certain period of time. However, there is a good chance that insurance policies do not cover lost income in the current climate (Where tenants cannot be evicted). Fortunately, most Australian insurance companies are standing firm on their original policies.

Note: Newer complexes may be covered under rental guarantee. This can be found on your sales contract.

What Does This Mean For Landlords?

- COVID-19 has brought about great changes that may or may not be prolonged into the year to come. Currently, the temporary laws set under COVID-19 Act 2020 are in play until the start of next year. Depending on where you are located in Australia.

- Under the current state, Landlords are being offered relief in minimal dosages. Tax relief may be a great start, but it cannot help cover your overall losses. The second phase of the tax relief system is about to begin, and we suggest you file your form along with the necessary documents as soon as possible.

- Apart from tax relief, landlords can get in touch with their bank or insurance provider to get an in-depth view of their situation. Allowing them to get a sense of what is to come, and how best to keep them afloat in the months to come.

What Should Landlords Do?

The best place to start right now is negotiations. Rather than sitting back and wondering what might come your way, start by acting on the information at hand. If you are facing issues due to loss of rental income then start by talking to your tenant(s) one on one.

- Keeping them in the loop about your situation while getting in touch with theirs will help you get a clear idea of what's to come.

- Transparency helps ensure a realistic approach from both sides. Allowing you to come up with reasonable terms.

- Make sure any and all agreements must be typed up and signed by both parties.

- Be reasonable while keeping the tenant's situation in mind.

- Get independent advice that can help you clear out your issues without causing any more distress.