Airbnb is the superstar of the new sharing economy. Enabling property owners or even those living in rental properties to provide a ‘locals’ living experience in tourist destinations whilst earning a reputable rental income.

But what are the tax implications in Australia for homeowners involved in such an economy?

Tax professionals are quickly adapting to the new airbnb tax regulations in Australia and the potential tax perks for home owners who choose to rent through this platform.

Renting your apartment or property using a sharing platform has proven to be so popular due to the incredible benefits to homeowners including;

- Ability to create additional income source

- Lucrative peak period income potential

- Healthy occupancy rates allowing for healthy income levels

PLUS - Beneficial Airbnb Tax Deductions mean big tax perks!

To keep ahead of the curve savvy home owners need a solid foundation of understanding on how sharing economy platforms affects their tax and also the Airbnb tax benefits.

With that in mind, we’ve gathered 6 of the best Airbnb tax tips we could find to help provide you a solid foundation to make the most of your rental. We’ve also included a comprehensive review of tax considerations to ultimately help you to maximise your deductions in order to reap the greatest return from your rental income.

If you rent through the sharing economy but are not a business (see whether you are deemed a business for tax purposes in part 5 of this article), then this article is for you.

IMPORTANT: Everyone’s situations are different. Therefore we recommend anyone participating in renting out their property have a tax accountant in their corner, come tax time. As an investment business there are much more complex rules around taxation. In this case it is advisable to seek professional business taxation advice.

6 of the best Airbnb tax tips

Below we will address;

- What expenses you can claim as tax deductions

- How to keep expense records that will maximise your tax deductions

- How to ensure you are maximising your deduction potential

- Why home rental seasonality matters in optimising your Airbnb revenue

- How an Airbnb home loan can increase your mortgage deductions

- How to ensure you come out on top against CGT triggered by Airbnb

These comprehensive tips include information you cannot live without if you are in possession of an active airbnb rental property. We will then answer frequently asked questions from our Airbnb hosts at the end of the article.

1. Claim all your rental fees & expenses to lower your tax payable

You have the potential to be claiming over 30 different expenses as an Airbnb host on your tax return! Airbnb expense deductions have the potential for some major savings on your Airbnb tax bill. Here's the ATO's offical page on deductions for the sharing economy.

IMPORTANT - With proper record keeping of when the room was actually rented and with proper expense claiming these tax perks of using Airbnb often pays off for hosts.

These allowable deductions form part of the Government tax incentives for homeowners.

Possible Airbnb Tax Deductions to Expense this year

For the purpose of this discussion your deductible expenses will either be;

- Fully deductible - for directly related expenses to the rented area

- Partially deductible - for shared areas where expenses need to be apportioned

- Not deductible - expenses related to the hosts private area

Fully Tax Deductible Expenses

Examples of expenses relating to your airbnb rental listing that may be fully deductible for tax purposes include;

- Furniture depreciation - especially easy to calculate if you rent furniture for the space depreciation of furniture used in the rented room

- commercial cleaning of the rented area

- repairs and maintenance

- food, such as breakfast provisions, made available to the guest

- professional photography for the listing

- service fees and commissions charged by Airbnb

- property management fees

Partially Tax Deductible Expenses

Examples of expenses relating to your entire rental property that may be partially deductible for tax purposes include;

- mortgage interest or rent;

- council rates;

- utilities; and

- insurance.

If you are only renting part of your home, for example a single room, you can only claim expenses related to renting out that part of the house. This means you cannot claim the total amount of the expenses – you need to apportion the expenses.

As a general guide, you should apportion expenses on a floor-area basis based on the area solely occupied by the renter (user), and add that to a reasonable amount based on their access to common areas.

You can only claim expenses for when the room was rented to a client. If you use the room in any other capacity, for example for storage or as an office when you do not have guests staying, then you cannot claim deductions for expenses when the room is not occupied.

Expenses that may not be deductible include;

- Travel and personal car costs

- Phone bills

IMPORTANT: Renting part or all of your home at less than normal commercial rates may limit the deductions you can claim and may raise a red flag with the ATO if you then claim a loss on your tax return.

ALSO IMPORTANT: Payments from family members for board or lodging are considered to be domestic arrangements and are not rental income. In these situations you also cannot claim income tax deductions.

When the property is vacant, can I still claim expenses?

The answer depends on whether you rent your whole property or part of your property.

Deductions when renting your whole short term rental property

Where you rent out a whole property, expenses are only deductible where an area of the house is either actually rented out, or available for rent.

For example, where a property is available for rent for 180 days a year then only the portion of rental expenses that were incurred over that 180-day period are deductible.

Note, it is not a requirement that the property is actually rented for the (in our example) 180 day period for rental expense deductions to be claimed. The property simply needs to be available for rent. Therefore, even if no guests stayed on the property during the 180 day vacancy period, if the property is advertised on Airbnb as vacant and available for rent, you can still claim deductions for the 180 day period.

Deductions when renting part of a short term rental property

Where you rent out only part of the property (such as a bedroom with access to shared areas in the property where you live), you can only claim expenses for the period the room is actually rented.

So, if you only rented the room for two weeks in a year, you can only claim the proportion of expenses for the rented part of the property which related to that two week period. This is to stop you claiming deductions for periods where the room might be used for private or domestic purposes, even though it was notionally available for rent.

2. Keep track of your expense record to facilitate your tax return

This is the best way to save on your tax bill at tax time.

Keeping an excellent record of everything relating to your Airbnb rental and making this paperwork easily available at tax time will ensure you can claim the maximum deductions related to Airbnb tax and expenses.

Save income statements, receipts with notes for what they are for and all correspondence. No need to over-organise it - just make sure you have a digital copy of everything saved somewhere secure (on a cloud server is best).

The important part is that you just stay in the habit of keeping evidence for expenses.

There are some super handy paid apps that can assist you (and especially your accountant) with this, plus the cost of the app per month will also be tax deductible, PLUS your accountant will love you. Here's the tax records the ATO suggests to keep.

Hubdoc & Receipt Bank are just two of the many that will link to your accountant’s software, your bank account directly and mean you can simply take a photo of the expense receipt on your phone and it’s recorded and saved for tax time.

IMPORTANT: Never hide rental income, due to the public nature of the sharing economy the ATO can track your income easily. The ATO is not “laid-back” about people who under-claim rental income and the risks of not keeping meticulous records of income and expenses is that it can lead to back taxes owing plus new fines, penalties and interest charges. This article explains more about how the ATO is cracking down on airbnb income.

Airbnb tax is real, even if you’re not earning a lot of money, be sure to have an idea of how much tax may be payable and keep excellent records of all income and expenses.

Here’s 5 steps to record keeping

- Understand the tax considerations of being a host

- Record all rental income

- Save all expense receipts and notes of what they were for - use apps to assist

- Make sure your tax agent knows everything to make the most of those Airbnb tax deductions

- Retain all records for a minimum of 5 years

By implementing the above record keeping process, you will not only make it easier for this year’s tax return, however will be facilitating much easy, pain free tax returns into the future.

You’ll also ensure you are maximising those deductions and minimising your overall tax bill.

3. Maximise space available for your guests to increase deductions

This tip is seductively simple, yet sexy.

When renting, expenses can only be deducted proportionally based on the area of the house that is being used for Airbnb purposes. Therefore increase the floor area dedicated to this purpose.

Here’s our Top 3 ways to maximise Airbnb floor area to increase possible deductions;

-

Keep personal effects & storage limited.

Anytime you utilise any of the rooms assigned for Airbnb purposes for personal storage you negate your ability to claim deductions. This is where Minimal living comes in. So keep all personal items out of the shared rental zone and in the garage. Even better Pull a ‘Marie Kondo’ to declutter, then assign the garage for Airbnb use and keep personal items stored in your bedroom or off site. -

Assign any spare living rooms, media rooms or study nooks to guest use, being sure to remove personal storage as above.

The idea is to increase the floor area assigned to Airbnb and decrease your personal floor area, this doesn’t have to mean you feel stranded in your own home, only that whatever area is assigned for Airbnb, needs to function as such. -

Renovate wisely.

If you are planning on renovating, be sure to include as much extra floor area space as possible in each new room assigned to guests. Increasing this area size directly increases the amount of deductions available.

4. Pay attention to State Government tax laws on short term rental limit

Hosts letting short term sharing economy properties in the Greater Sydney area will only be allowed to rent out their home for up to 180 nights a year and still be deemed residential. Past this they are commercial and deemed a business for tax purposes.

Currently only applicable in the Greater Sydney region, however the best example of why, when and for how long you list a rental for plays a huge part in managing your revenue and tax.

It is crucial you carefully select the periods and seasons in which you list your property for short term rental.

Peak home rental seasons

Here are the prime peak periods of seasonality to consider;

- January and February - school holidays, Aussie summer and also prime tourist season make these peak months fairly self explanatory.

- Easter - school holidays and also high travel rates over this holiday equate to a great time to consider listing your rental.

- Christmas - family get togethers over the festive season quite often call for a larger airbnb rental for the family to stay in, particularly important for larger properties with more bedrooms but also important for smaller shared room properties that may be hosting guests visiting family over this period.

The quietest month on average is May.

5. Increase your financing with an Airbnb Income home loan for higher mortgage deductions

Thinking about buying an Airbnb home? Maybe you’re already hosting on Airbnb but need to re-vamp your rental property for better returns?

An Airbnb home loan may be the answer.

Lending institutions in Australia have been slow to recognise the income generated by the sharing economy when processing loan applications, however the tide is turning.

There are now some lenders in the market who will consider short term rental income as part of the loan application, after successful results with the lending market in the US.

Not only can existing short term rental home owners benefit from this new type of lending but future home owners can also plan for this in their home loan application.

What is an Airbnb home loan?

An airbnb home loan is one that recognises your short term rental income as part of the home loan lending application criteria.

It’s inherently an investment loan, meaning you are buying a property for investment purposes and this forms part of your home loan.

Thus by doing so legitimises Airbnb income against your mortgage and may increase your deductions.

Airbnb in all lenders eyes currently is generally considered holiday lettings - as short term lets qualify under holiday lettings. This means the income you earn from it is shaded by 50% or more depending on how consistent you can demonstrate that income to be.

The maximum contribution top tier banks will currently extend to is 50% of income, which then has to be consistently demonstrable over a minimum of 2 years.

IMPORTANT: Due to the nature of the lend your interest rate may be higher than an owner occupied rate because of possible inherent risk to repay the debt on a month to month basis.

If it’s wholly used for holiday lettings, there are some circumstances where the value of the property will be shaded again, therefore there is a risk the LTV can reduce further.

If you’re seriously considering this type of loan you could contact a financial broker for further guidance in navigating lending options.

Leveraging your short term rental income home loan for your existing home

Rather than a traditional equity loan against your existing home, consider structuring a loan against your Airbnb income.

NOTE: To achieve this in most cases a the maximum contribution top tier banks will currently extend to is 50% of income, which then has to be consistently demonstrable over a minimum of 2 years.

The ability to repay your loan will also be calculated with approximately a 6-7% interest rate on the loan repayments. Meaning if you can’t afford to repay the loan amount with 6-7% interest it’s unlikely you will receive the loan.

A general means test is to also look at 2.25% above carded rate - government issued interest rate as a measure for your capability. For example is the carded rate was 5% than you would need to show the ability to repay at 7.25% minimum.

Obtaining a Airbnb home Loan for a new investment

The most prudent path for obtaining such a loan is to talk with an experienced finance broker.

Benefits of Airbnb Home Loans

- The higher the % of finance on your home loan, the higher your ability to increase tax deductions against this property.

- Higher mortgage tax deductions

- Higher mortgage interest deductions

Ultimately you could be claiming some of your interest payments on your investment loan.

IMPORTANT: Interest originating from a loan not contracted for hosting purposes cannot be deducted from your property rental related activities as a tax deduction.

What about a long term rental property moving to a short term rental?

Can I continue to claim tax deductions?

When moving from a long term property arrangement to a short term property arrangement great care is needed to ensure you are making the right move. It is always best to start by reading what the ATO states about renting out part or all of your home here.

According to a report commissioned by Airbnb;

"Broadly, in Sydney and Melbourne, it is not more financially beneficial to host a property on a sharing platform instead of renting to a long term tenant. In only a small number of cases, mostly in areas where hotels are too expensive, it is more profitable to list a property on Airbnb full time rather than on the rental market."

In saying that we must recognise that there is much greater income potential with short term rentals. By working with professionals to manage and optimise your short term rental you may find the financial gains beneficial.

In answering the question around continuing to claim tax deductions the answer depends on how you manage the letting of the property as a short term rental.

If you are renting the whole property as a short term rental than most deductions will carry forward, however if you plan to move back in and simply rent part of the property, many of your deductions will change.

IMPORTANT: We advise to seek professional advice from your financial planner or accountant regarding the tax changes you may experience based on your personal circumstances.

6. Calculate the Implications of Airbnb rental on future capital gains taxes and balance against income potential

Renting through the sharing economy will trigger the need to calculate Capital Gains on the sale of your home.

How much of the gain is taxable and how much is covered by the main residence exemption is calculated as below.

Calculating the capital gain that is not exempt requires record keeping and some clear starting points.

Check out the ATO's page on working out your capital gains for Airbnb here.

Then when preparing to calculate what your gross capital gains may be after you sell your home of a few key factors need to be known.

These include;

- Total floor space apportioned to producing rental income

- Total period of time the space was used for this purpose - Starting from the date which the property was first used to generate income

- Your eligibility for the absence rule (see more on Treating a dwelling as your main residence after you move out)

- whether it was first used to produce income after 20 August 1996.

To assist you in calculating the proportion of your capital gain that will be exempt from CGT try using the ATO’s Property exemption tool or talk to your tax accountant who will be able to assist in providing an accurate scenario tailored to you.

IMPORTANT: Although you may not be free from Capital gains tax (CGT) when selling your home, your gain will generally qualify for the 50% Capital Gains Tax discount on any applicable gross capital gains.

PLUS don’t forget the value of all the extra tax deductions to your overall tax invoice.

Short term rental income Vs Airbnb Capital Gain Taxes

It’s a trade off, healthy short term rental income for you now may mean higher gross capital gain liabilities for tax when you sell your property. However the rental income you make from Airbnb will usually outweigh the later effects of CGT, but not always.

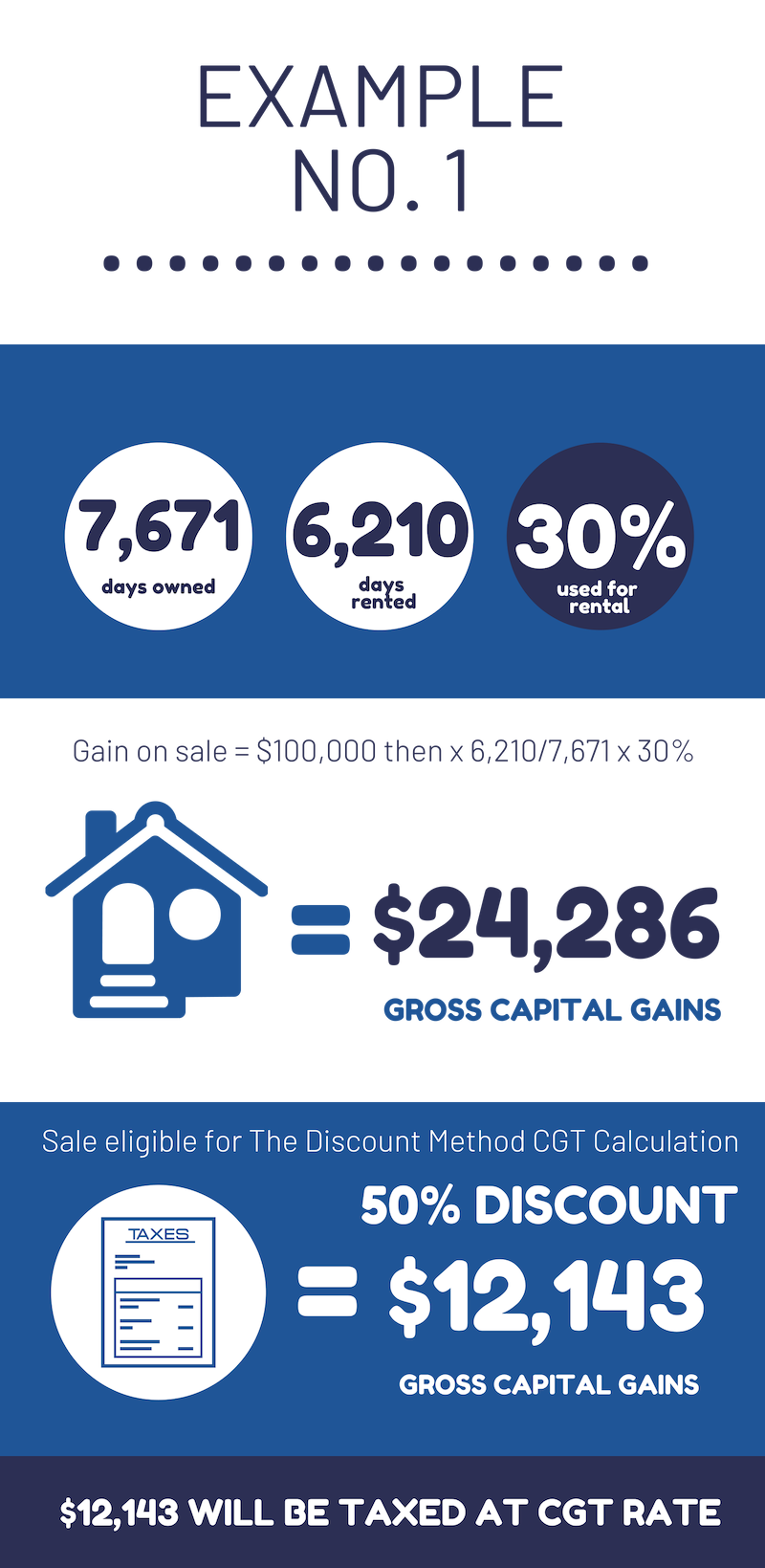

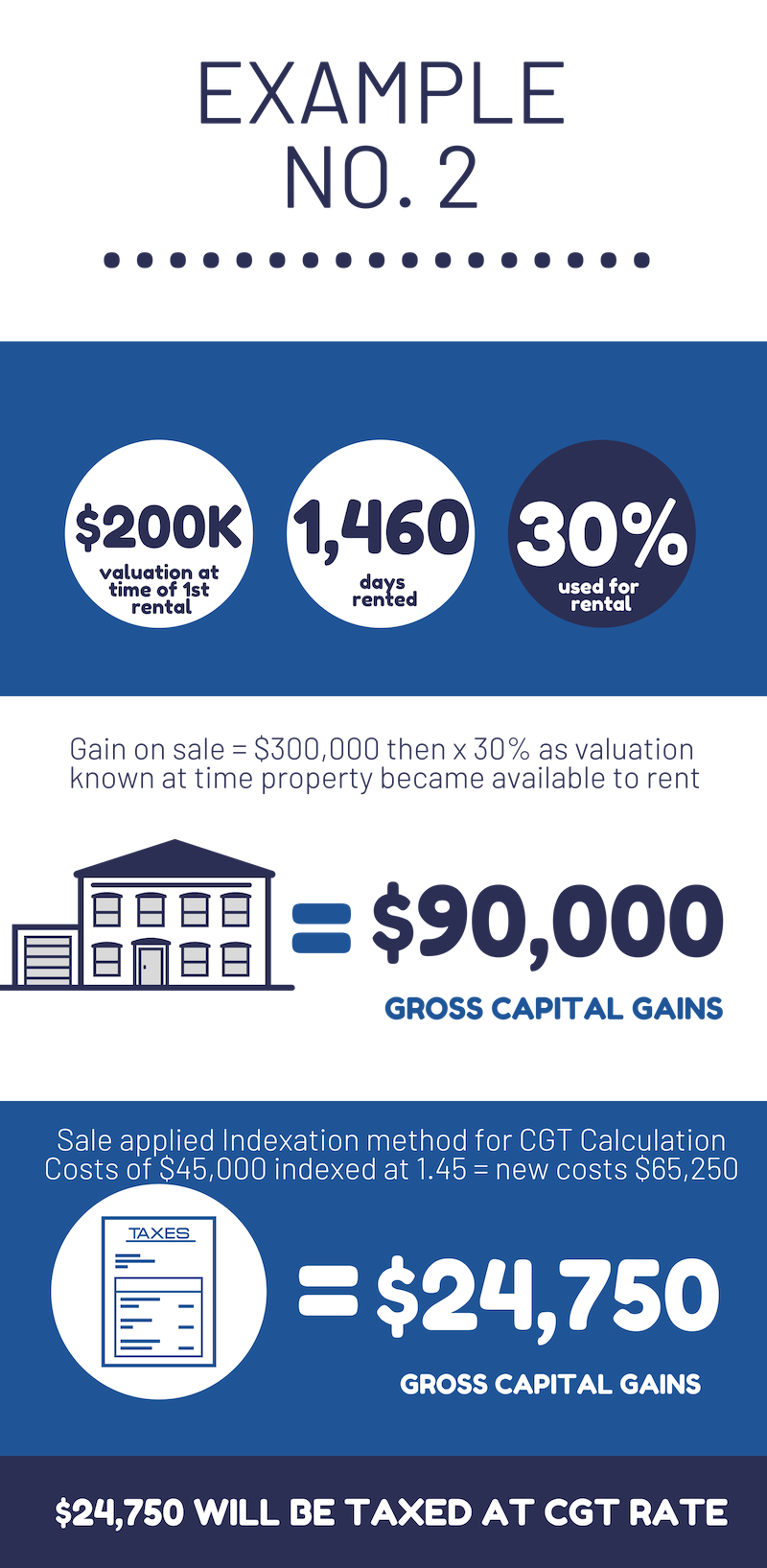

Here’s two examples showing the affects of CGT;

In this example at an average nightly rate of $90 the total income over the lifespan of the property from this airbnb rental would have been $558,900! Therefore tax on $12,143 may seem much more affordable then not having created the income in the first place.

In this example at an average nightly rate of $200 the total income over the lifespan of the property from this airbnb rental will have been $292,000!

KingsCoin provide full Airbnb Property Management and hosting services for busy home owners to help them make more coin from the Airbnb rental. Whether you considering Airbnb or already on Airbnb looking to boost your income KingsCoin will help for rentals in Adelaide, Sydney, Melbourne, Brisbane and the Gold Coast.

Let's finish by clearing up a few Frequently Asked Questions (FAQ) that will inform our top tax tips we hear from all of our short term rental clients. Below we will answer;

- How Airbnb rental income affects your tax return

- Why Airbnb may affect your future Capital Gains Tax (CGT)

- How do you calculate the implications of Airbnb rental income on your future CGT?

- Is Short Term Rental Income VS Airbnb Capital Gains Taxes worth it?

- Is Goods and services tax applicable on an Airbnb apartment?

Frequently asked questions from beginner Airbnb home renters

Airbnb rental income & your tax return

You may be wondering how Airbnb income affects your income tax here in Australia.

Firstly, earning rental income from the sharing economy is a great boost for many homeowners however let’s be clear that any extra income you earn means the ATO will charge you more tax at the end of the financial year.

IMPORTANT: Any new income source, means more tax to pay at the end of the financial year. It is important to save a portion for tax and also keep meticulous records to ensure you get as much of that back as possible.

The ATO states “If you rent out part or all of your home, the rent money you receive is generally regarded as assessable income.”

Therefore you must declare all income from Airbnb on your income tax return. This may increase your income tax payable, however the great news is you may be entitled to tax deductions for expenses incurred in providing a short term rental. See full details in our Top Tax Tip #1.

IMPORTANT: When receiving any rental income you should prepare for early instalments. This means keeping a portion of your income aside for tax time, to ensure you will meet your obligation.

Implications of Airbnb rental on future capital gains taxes

Here’s why Airbnb income may affect your future Capital Gains Tax (CGT);

Generally when not receiving income for renting part or all of your home under the main residence tax exemption you are not subject to Capital Gains Tax (CGT) when selling your family home.

So will renting through Airbnb trigger Capital Gains Tax when selling your home?

In short, yes it will. It's reported that many Airbnb hosts are ignoring this fact and may face a untimely surprise when they sell their house.

The ATO make it clear here that if you’ve used any part of your home to produce income - this includes renting it out through any sharing economy platform - you’re generally not entitled to the full CGT exemption.

IMPORTANT: It’s important to keep in mind that rental income you make will usually outweigh the later effects of CGT, but not always. This will need to be considered and managed carefully. See examples of this in our Top Tax Tip #6.

Airbnb & GST in Australia: Do I need to charge GST for Airbnb?

Is Goods and service tax (GST) applicable on an Airbnb apartment?

No, GST is not applicable for residential Airbnb transactions. This is the case even if your turnover exceeds the threshold of $75,000.

The ATO states “Good and services tax (GST) doesn't apply to residential rents, so you're not liable for GST on the rent you charge, and can't claim GST credits for associated costs.”

However if you find yourself deemed as a commercial property or business, this will change and you may need to register for GST.

NOTE: Tax rules and legislation change both Federal and State, check with you accountant for up to date advice specific to your particular income, property and situation. The above is broad and general information only and is not meant to be individual tax advice.

***